Vittaverse has officially joined the Financial Commission as a recognized member, marking a significant development in the foreign exchange industry’s growing interest in independent external dispute resolution (EDR) services.

This announcement underscores Vittaverse’s unwavering commitment to providing a secure and transparent trading environment for its clients.

Effective as of January 18, 2024, Vittaverse’s membership application has been approved, granting the company and its clientele access to a variety of services offered by the Financial Commission.

Notably, this includes protection of up to €20,000 per submitted complaint, backed by the Financial Commission’s Compensation Fund.

The Financial Commission, serving as an impartial third-party mediation platform, plays a pivotal role in facilitating efficient dispute resolution for participants in the fields of Contracts for Difference (CFDs), forex, and cryptocurrency markets.

In an innovative departure from conventional regulatory channels like arbitration or local court systems, the Commission offers invaluable support in resolving issues stemming from direct agreements between involved parties.

As an independent EDR organization, the Financial Commission extends its services to consumers and traders who are unable to resolve disputes directly with their financial services providers.

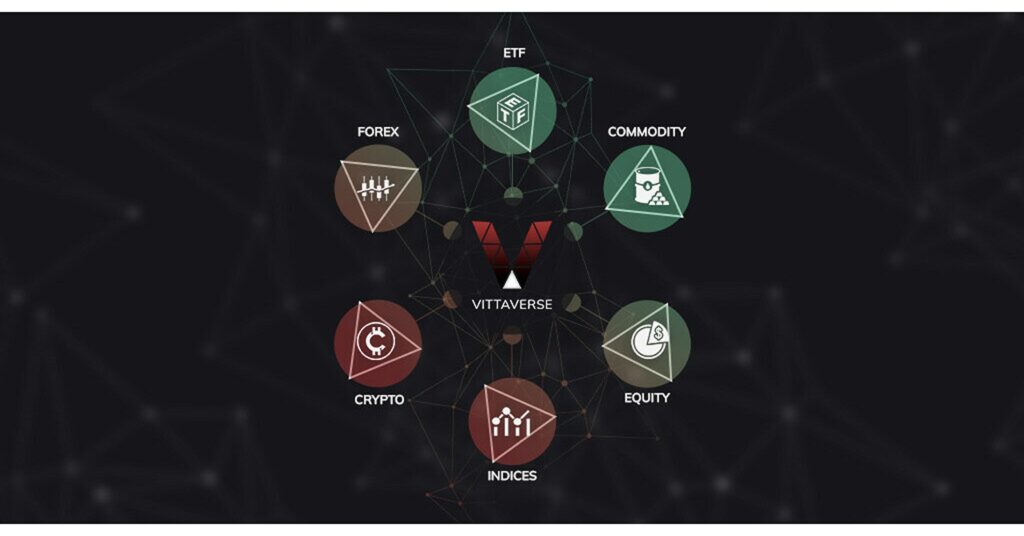

Initially centered on addressing concerns within electronic markets, particularly the Foreign Exchange sector, the Commission has expanded its scope to encompass CFDs, derivatives, and the certification of technology platforms in the trading realm.

In a previous report, Finance Magnates disclosed that the Canadian Securities Administrators (CSA) removed the Financial Commission’s (FinCom) name from its ‘Investors Alert’ list after resolving misunderstandings.

In June 2023, the CSA had previously mislabeled FinCom, a self-regulatory and dispute resolution entity in the financial services sector, as a fraudulent entity along with ten other names.

The Financial Commission promptly contested the warning through legal channels.

However, the CSA did not provide any reasons for initially listing FinCom or for subsequently removing it from the alert list.

The confusion appeared to be linked to a clone scam involving counterfeit details of legitimate financial services firms, which were deceiving investors.

Consequently, the Blockchain Commission, FinCom’s blockchain unit, is currently dormant, with social media being identified as a contributing factor to the proliferation of such clone scams.

In sum, Vittaverse’s inclusion as a member of the Financial Commission signifies a strengthening commitment to ensuring the safety and transparency of the foreign exchange industry, while the Commission itself remains a vital player in the resolution of disputes in the ever-evolving financial markets.