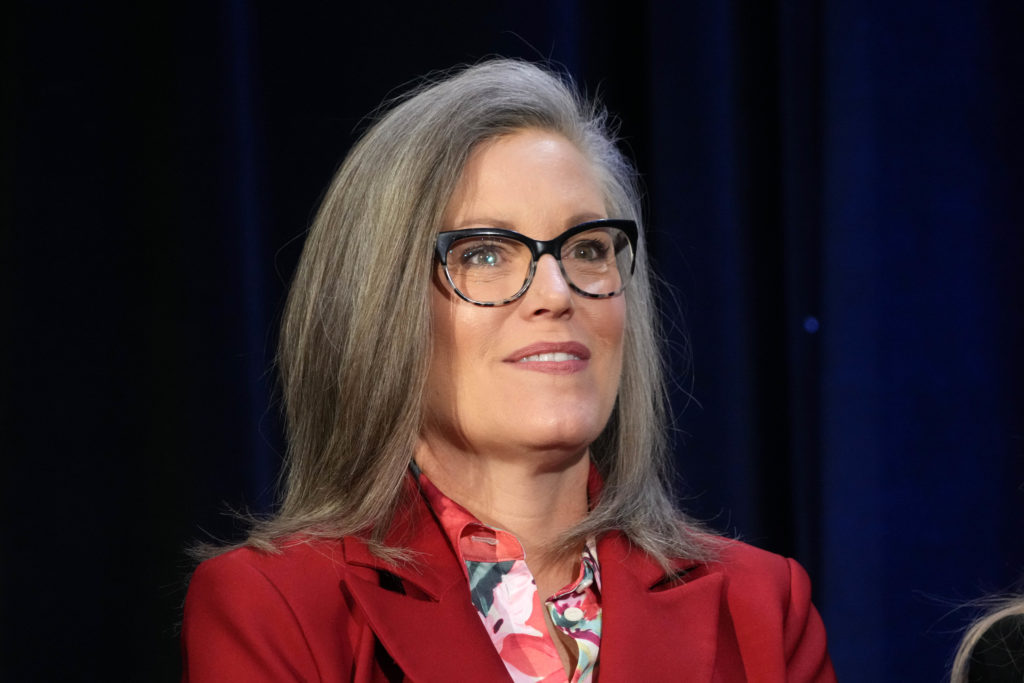

Arizona Governor Katie Hobbs has vetoed a bill that aimed to establish a state-controlled fund for digital assets seized in criminal cases, arguing the measure could undermine local law enforcement cooperation.

House Bill 2324 proposed creating a Bitcoin and Digital Assets Reserve Fund to manage forfeited crypto assets. The bill passed the House with a 34-22 vote on June 24, following a revival by the Senate after an earlier rejection.

However, Hobbs vetoed the measure on Tuesday, stating in her letter that the bill “disincentivizes local enforcement from working with the state on digital asset forfeiture by removing seized assets from local jurisdictions.”

Under the bill, the first $300,000 of seized crypto would be allocated to the attorney general’s office. Amounts beyond that would be divided among the AG’s office (50%), the state general fund (25%), and the new reserve fund (25%).

Pattern of Vetoes Against Crypto Initiatives

This is not Hobbs’ first rejection of cryptocurrency legislation.

She previously vetoed Senate Bill 1025 in May, which would have allowed the state treasurer to invest up to 10% of reserve funds in Bitcoin. Hobbs cited concerns about cryptocurrencies being “untested investments.”

Another measure, Senate Bill 1373, which proposed creating a digital assets reserve using seized crypto, was also vetoed.

Despite the recent veto, Arizona has enacted House Bill 2749, which integrates crypto into the state’s financial and unclaimed property framework. The new law, passed in May, also establishes a Bitcoin and Digital Assets Reserve Fund under the state treasurer’s management.

Broader National Crypto Legislative Efforts

Arizona’s debate on crypto reserves is part of a broader national trend.

Texas recently passed legislation to create a state-run Bitcoin reserve. Similarly, New Hampshire approved a bill to invest in both cryptocurrency and precious metals. At least six other U.S. states are advancing similar measures to incorporate digital assets into their financial systems.